- Ring The Bell

- Posts

- $700B Tech Selloff | Top Hedge Fund Picks + Top 10 Short Squeeze Stocks To Watch

$700B Tech Selloff | Top Hedge Fund Picks + Top 10 Short Squeeze Stocks To Watch

Plus, Ted Cruz sells this big winner, Michael Burry closes his hedge fund, and more

Happy Friday! Yesterday’s market bloodbath was one of the worst of the season as tech stocks combined to lose more than $700 billion. Read on to see what’s driving the selloff and how to position for the next move.

Also, Bitcoin broke below $100,000 — a key threshold — to hit its lowest level since May. Could this be the start of a deeper sell-off, or is this setting up for a big rebound? Click here to see what traders are watching next.

In addition, this hedge fund just released its newest picks. Did yours make the list? Read on for the full list.

Plus, if you’re looking for a strategic investment in the rapidly growing natural graphite market, check out today’s sponsor.

In Today's Edition

TOP STORY

Tech stocks plunged yesterday, wiping out more than $700 billion as the market’s AI-fueled optimism hit a wall.

Investor sentiment shifted sharply amid fresh signals from the Federal Reserve that rate cuts may be further off than expected.

In addition, the AI sector faces its toughest task yet for its next phase of growth. Discover what’s driving the selloff, and how to position for the next move.

SPONSORED CONTENT

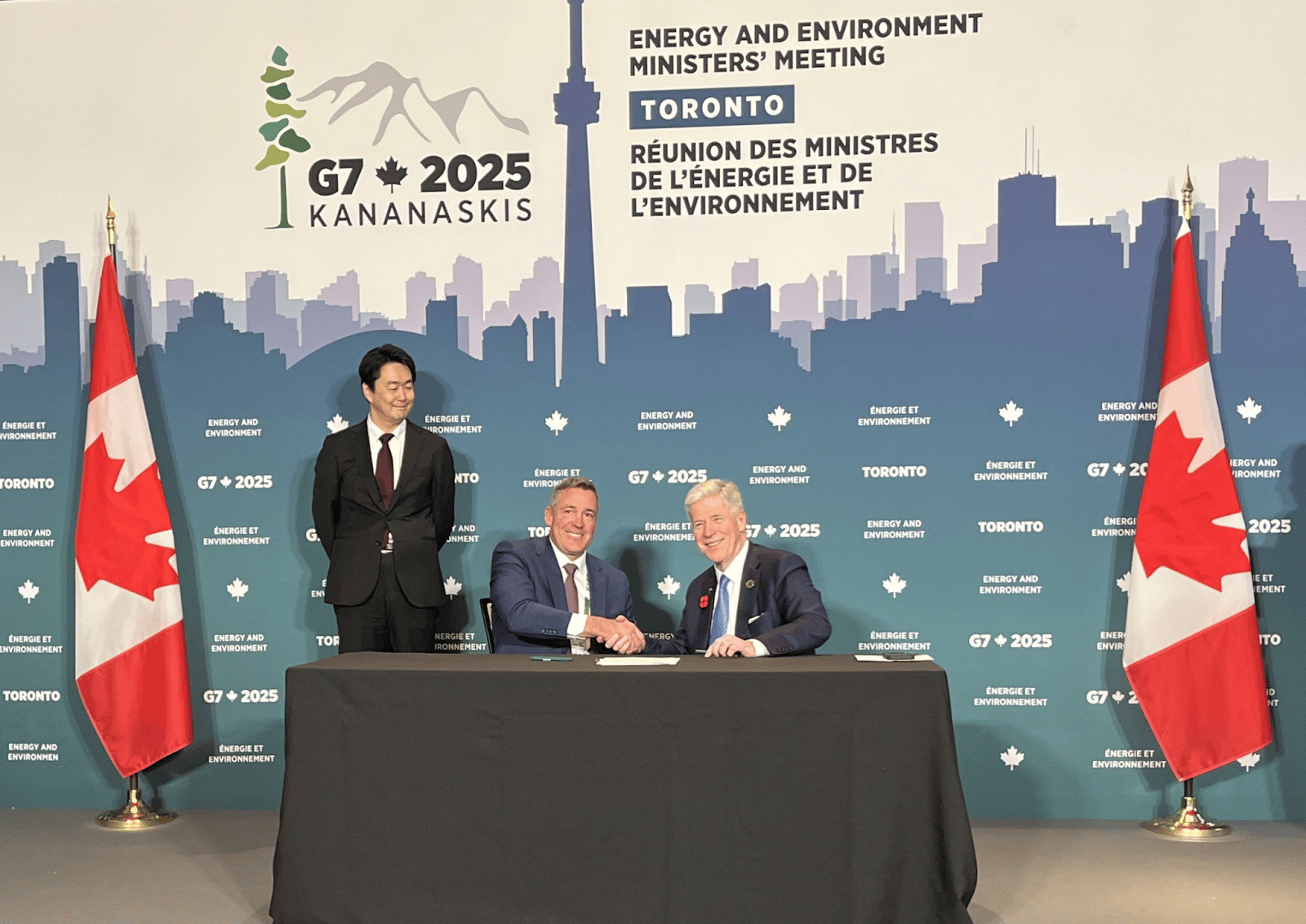

Following the G7 shift from strategy to deployment, what comes next for the graphite sector? Nouveau Monde Graphite’s recent offtake agreements, potentially covering nearly 100% of future Matawinie Mine production, represent a rare market signal between public and private stakeholders for a project sold out before breaking ground.

On track to becoming one of the Western World’s largest, fully vertically integrated productions of natural graphite, NMG is now in a highly strategic position to enter a growth market. Ready to supply advanced graphite as an alternative to China, it advances toward financing and construction with firm contracts, completed permitting, advanced engineering, community partnerships, and government backing.

This offers investors a moment of unique clarity. The market may potentially not yet fully reflect the project’s long-term strategic potential marked by commercial alignment, government support and validated demand, with construction in sight.

This is a paid ad. Please see 17b disclosure here for more information.

MARKET RECAP

| Averages & Assets | ||||

| Asset | Close 11/13/25 | Price Change | ||

| $6,737.49 | -1.66% | ||

| $22,870.36 | -2.29% | ||

| $47,457.22 | -1.65% | ||

| 4.12% | +0.04 bps | ||

| $45.52 | +5.10% | ||

| $121.53 | -8.61% | ||

| $99,730.00 | -1.77% | ||

| $3,235.73 | -5.10% | ||

| $2.33 | -2.10% | ||

Yesterday: U.S. indexes plunged on Thursday, marking one of the worst days since the tariff saga started in April. The Dow slid roughly 1.7%, reversing Wednesday’s record rally in which it surged over 48,000 for the first time. AI and Big Tech dropped heavily to put the Nasdaq on course to end its seven-week rally as concerns over stretched valuations, rising debt issuance and surging capex plans fueled the selloff. In addition, President Trump signed a stopgap spending bill to end the 43-day government shutdown, though the staggered return of economic data releases may complicate the Federal Reserve’s policy assessment ahead of its December 10 meeting. Wall Street is now pricing in less than a 50% chance of a rate cut next month, down from 70% a week earlier.

MARKET HEATMAP

With markets in a freefall on Thursday, almost nothing was spared as Bitcoin slid below $100,000, Disney (DIS) tumbled the most since 2022 and Tesla (TSLA) and Robinhood (HOOD) plunged, too. But those weren’t the only companies making big moves. Here’s a look at some of the biggest winners and losers on Thursday.

Discover how the market is moving with our interactive heatmap. Filter by market cap, or click on any box to explore specific sectors or assets in more detail.

FIVE ZINGERS

Goldman Cruz: Senator Ted Cruz just sold a chunk of Goldman Sachs shares in a rare move for the Texas lawmaker. Click to see why this trade could signal bigger shifts in the market and what it means for investors.

Fund Farewell: Michael Burry just closed his hedge fund, and cleared the air on his Palantir trade. Here are all the details of one of Wall Street’s most closely followed contrarian investors.

Profit Launch: Virgin Galactic shares are shooting for the stars after Q3 results showed narrowing losses and steady cash on hand. Buckle up and discover how the company’s 2026 commercial spaceflights could take investors’ portfolios into orbit!

Chip Surge: Applied Materials just crushed Q4 expectations, fueled by AI-driven semiconductor demand. So why did shares fall after hours, and is the selloff a buying opportunity? Here’s everything you need to know.

Risk/Reward: When heavily shorted stocks spike, the rush to cover can ignite. Here’s a look at the top 10 most shorted stocks for a potential short squeeze.

SPONSORED CONTENT

With Washington opening back up and the backlog of data about to drop, traders are entering another high-risk, high-reward stretch. Each new report or Fed clue could swing markets fast, and Matt Maley is preparing for it now. Join him Sunday, November 16 at 1:00 p.m. ET for a live strategy session covering the setups, indicators and risk-management tools he’s using to trade this uncertain window before the Fed minutes land.

MARKET HISTORY

On This Day In 2014…

Virgin America made its public debut on the Nasdaq under the ticker VA after pricing its IPO at $23 per share and raising just over $300 million. The stock jumped roughly 30% on its first day of trading, reflecting strong investor interest. Though the company remained small compared to legacy competitors, going public gave it fresh capital to expand its fleet and routes. The story ultimately came full circle when Alaska Airlines acquired Virgin America in 2016, turning the IPO into both a brief success and the beginning of the brand’s eventual sunset.

QUOTE OF THE DAY

“The three most important words in investing are margin of safety.“

— Warren Buffett

BEFORE YOU GO

Were you forwarded this email? Click here to subscribe.

And be sure to check out our other newsletters:

Future Finance: Where fintech, crypto and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Advisor: Tailor-made for Financial Advisors, this weekly newsletter has industry-specific insights, analysis and news. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets and mind-blowing tech trends. Subscribe here.