- Ring The Bell

- Posts

- AMD-OpenAI Landmark Deal Ignites Historic Surge — Why Gold Prices Could Double By 2030

AMD-OpenAI Landmark Deal Ignites Historic Surge — Why Gold Prices Could Double By 2030

Plus, Goldman Sachs issues Nvidia warning, Tesla showcases robots, earnings, and more

Happy Tuesday! Shares of AMD skyrocketed yesterday for the largest daily jump in almost 10 years after the company unveiled a multi-year agreement with OpenAI. But while some see bubble risk, AMD’s CEO sees opportunity and is doubling down. Read on to see why, and which company OpenAI may be targeting next.

Also, gold has been on a tear this year and is off to its best performance since 1979, but one veteran strategist says the real fireworks haven’t even started yet. What’s fueling his jaw-dropping $10,000 price target — and could it actually happen? Read on to find out.

Plus, if you’re looking for a smarter way to predict stock moves based on data and consumer behavior, check out today’s sponsor.

In Today's Edition

TOP STORY

Advanced Micro Devices (AMD) notched its largest single-day gain in nearly a decade — soaring more than 30% before finishing up 24% on the day.

The spark came from a multi-year agreement with OpenAI that could funnel tens of billions in revenue toward AMD starting in 2026. While some market watchers fear an AI bubble, AMD CEO Lisa Su isn’t flinching. In fact, she’s doubling down.

Read on to see why, and what company OpenAI may be targeting next.

SPONSORED CONTENT

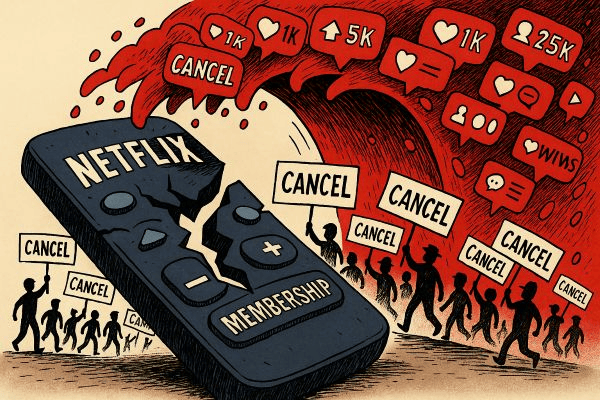

When consumer outrage goes viral, even billion-dollar brands can get burned.

In 2020, Netflix weathered its biggest cancellation wave ever — and still finished the year strong. This time, the storm looks different.

LikeFolio’s latest deep dive shows social backlash and cancellation intent now surging to levels twice the “Cuties” peak, with engagement metrics off the charts and losses concentrated in Netflix’s most profitable region.

Inside, you’ll see:

How a viral “Cancel Netflix” campaign tied to kids’ content exploded into a political firestorm with 100K+ likes per post

Why this time churn matters far more than 2020 — and how $17 billion in high-ARPU revenue is suddenly at risk

Which LikeFolio data points could give investors an early read before Netflix reports Q3 earnings

MARKET RECAP

| Averages & Assets | ||||

| Asset | Close 10/06/25 | Price Change | ||

| $6,740.28 | +0.36% | ||

| $22,941.67 | +0.71% | ||

| $46,694.97 | -0.14% | ||

| 4.16% | -0.00 bps | ||

| $203.71 | +23.71% | ||

| $587.00 | -14.03% | ||

| $124,774.00 | +1.03% | ||

| $4,689.13 | +3.85% | ||

| $2.99 | +0.67% | ||

Yesterday: U.S. indexes ended mixed again, with the S&P 500 and Nasdaq closing at record highs, fueled by a surge in deal activity and strong tech momentum. The S&P 500 rose 0.36%, extending its winning streak to seven consecutive sessions, while the Nasdaq gained 0.71%, boosted by a 24% rally in AMD after the chipmaker struck a deal with OpenAI. The Russell 2000 also notched a record close and briefly crossed the 2,500 mark for the first time. Oil prices rose more than 1% after OPEC+’s planned production increase for November was more modest than expected, tempering some concerns about supply additions. Lastly, despite the ongoing government shutdown, investor sentiment continues to be resilient, with the S&P 500 logging its 32nd record close this year.

On Our Radar: Analysts will be watching the trade deficit and consumer credit reports, as well as remarks from a number of Fed officials throughout the day (Bostic, Bowman, Miran, Kashkari). On the earnings front, all eyes will be on Saratoga Investment (SAR) and Penguin Solutions (PENG), which will report results after the market close today.

MARKET HEATMAP

Shares of AMD (AMD) and Super Micro (SMCI) were some of the top gainers, while Verizon (VZ), AT&T (T) and Starbucks (SBUX) were some of the top losers. But those weren’t the only companies making big moves. Here’s a look at some of the biggest winners and losers on Monday.

Discover how the market is moving with our interactive heatmap. Filter by market cap, or click on any box to explore specific sectors or assets in more detail.

FIVE ZINGERS

SPECIAL OFFER

With the shutdown delaying key economic reports, traders are navigating without their usual playbook. That uncertainty is making every earnings release and corporate guidance update more impactful than usual, sending fresh waves of volatility through the market.

On Wednesday, October 8, at 6:00 p.m. ET, Benzinga’s Chief Market Strategist Matt Maley will reveal how he’s adapting to this environment and where he sees the most actionable opportunities for traders right now.

MARKET HISTORY

On This Day In 2015…

Pure Storage priced its initial public offering at $17 per share, raising $485 million. Initial excitement was underwhelming as shares opened below that level and closed at $16.01, down nearly 6% on the day. At the time, the IPO was among the largest venture capital-backed tech offerings of 2015, with a valuation of just over $3 billion. Fast forward to today, and Pure Storage’s journey has taken wings as shares now trade at $87 and the company's market cap is more than $28 billion, nearing a tenfold increase since its IPO.

QUOTE OF THE DAY

“Given a 10% chance of a 100 times payoff, you should take that bet every time.“

— Jim Rogers

ONE FOR THE ROAD

Gold is having a record-breaking year, and market veteran Ed Yardeni thinks we’re only scratching the surface. Up nearly 50% on the year — marking the metal's best performance since 1979 — and with prices flirting with $4,000, Yardeni is raising his price targets once more.

The market veteran believes Gold could hit $5,000 next year and $10,000 by 2030 as investors rush into gold ETFs in record numbers. Read on to see what’s behind his bullish call.

BEFORE YOU GO

Were you forwarded this email? Click here to subscribe.

And be sure to check out our other newsletters:

Future Finance: Where fintech, crypto and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Advisor: Tailor-made for Financial Advisors, this weekly newsletter has industry-specific insights, analysis, and news. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets and mind-blowing tech trends. Subscribe here.