- Ring The Bell

- Posts

- Google Makes Zillow Plunge | Top Analyst Gives 11 Bold Predictions for 2026

Google Makes Zillow Plunge | Top Analyst Gives 11 Bold Predictions for 2026

Plus, Amazon's failed acquisition goes bankrupt, and more

Happy Tuesday! One of Wall Street’s most closely followed analysts just shared his outlook for the coming year. Take a look at all his bold predictions and insights to get help supercharge your portfolio.

Also, when Google makes a move, markets notice and Zillow was the latest to be in the crosshairs. A small change with big implications sent the stock crashing and raised questions about the future of real estate. Read on for all the details.

Plus, if you’re looking to take diversification to a new level with your portfolio, check out today’s sponsor.

In Today's Edition

TOP STORY

Gene Munster is one of the most followed and influential analysts on Wall Street, and the longtime market veteran just dropped his annual predictions for the coming year, with some surprising calls.

From AI to the Magnificent 7, to small cap stocks and executive shakeups, read on to see where he expects everything to land, and how you can get ahead of Wall Street and supercharge your portfolio.

SPONSORED CONTENT

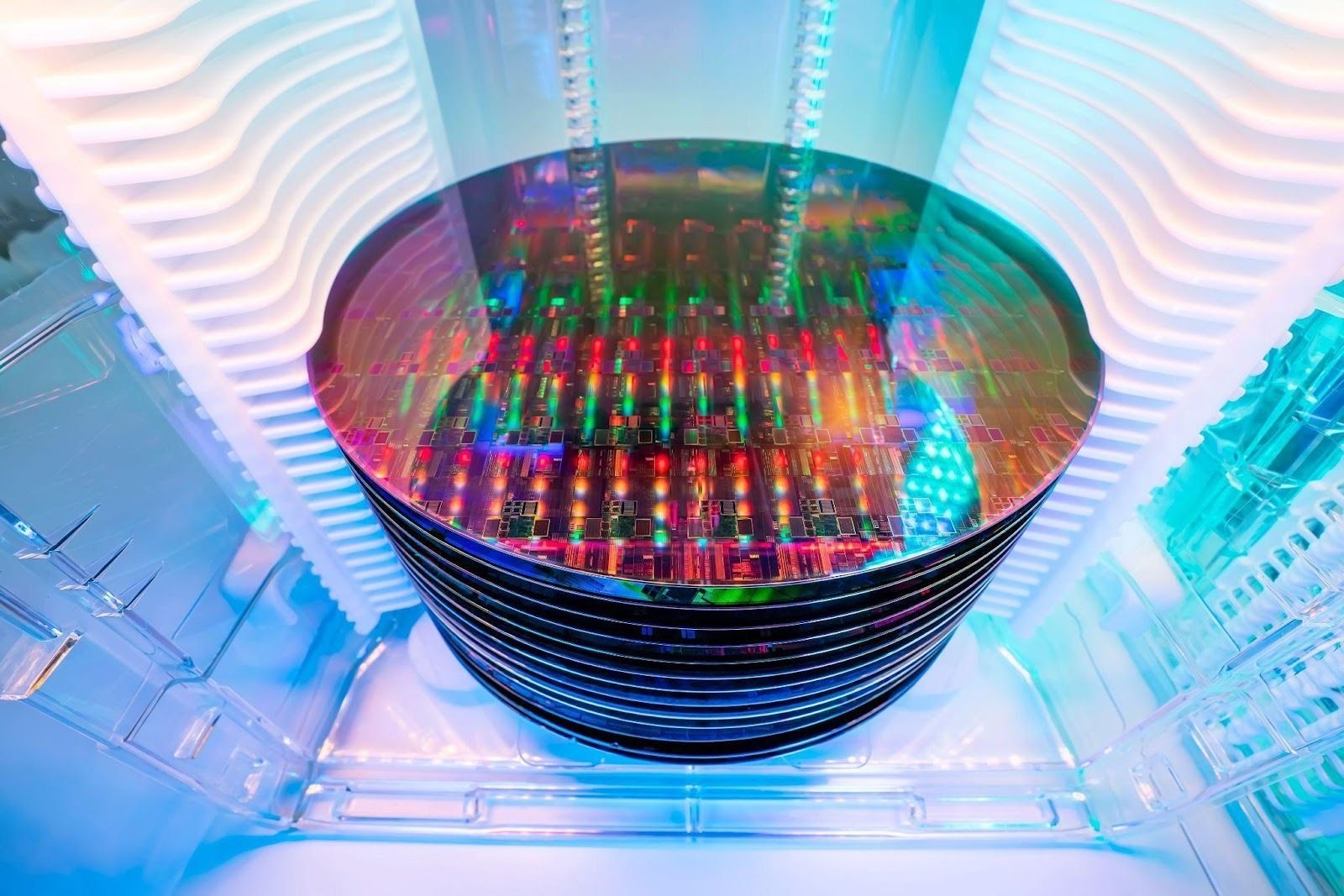

The Xtrackers US National Critical Technologies ETF (CRTC) offers investors structured access to the technologies that underpin America’s long-term economic and national security agenda. By tracking a rules-based index aligned with six Department of War–defined priority sectors, CRTC provides diversified exposure to companies driving breakthroughs in semiconductors, AI, biotech, quantum computing, energy resilience and more. Its integrated Geostrategic Risk Rating helps filter out firms entangled with adversarial nations, giving investors a clearer, more resilient technology profile.

For those seeking targeted exposure to America’s most consequential innovations, CRTC deserves a serious look — explore it further today.

This is a paid ad. Please see 17b disclosure here for more information.

MARKET RECAP

| Averages & Assets | ||||

| Asset | Close 12/15/25 | Price Change | ||

| $6,816.51 | -0.16% | ||

| $23,057.41 | -0.59% | ||

| $48,416.56 | -0.09% | ||

| 4.18% | -0.01 bps | ||

| $246.35 | +5.33% | ||

| $765.20 | -11.54% | ||

| $86,414.00 | -2.06% | ||

| $2,964.49 | -3.22% | ||

| $1.90 | -4.04% | ||

Yesterday: U.S. indexes closed lower Monday, extending last week’s declines, as large-cap and technology stocks — including Broadcom, Oracle, and Microsoft — weighed on the market. In addition, investors continued to rotate towards economically sensitive sectors such as consumer discretionary, industrials, and health care due to lower interest rates. Regarding the other areas of the market, bonds rallied and gold held steady after last week’s highs. Meanwhile, oil slipped near 52-week lows and bitcoin continued its downtrend, forming lower highs and lows. The U.S. dollar remained under pressure, down nearly 10% for the year after a prolonged bull run.

MARKET HEATMAP

Shares of Tesla (TSLA) climbed, marking the 12th gain in the past 15 sessions. But it wasn’t all rosy for stocks with ServiceNow (NOW) and Zillow (Z) tanking. Here’s a look at some of the biggest winners and losers on Monday.

Discover how the market is moving with our interactive heatmap. Filter by market cap, or click on any box to explore specific sectors or assets in more detail.

FIVE ZINGERS

iZoombie Squeeze: iRobot just filed for Chapter 11 bankruptcy, however, retail traders are already circling for a classic “zombie squeeze” that could send shares soaring. Read on to see how it compares to past past squeezes such as Hertz and Bed Bath & Beyond and what to watch.

Bubble Trouble: AI stocks don’t look like a bubble yet, but this research firm believes the danger could take place next year if the Fed isn’t careful. Here’s all the details.

AI, ETH, And Beyond: BitMine just added over 100,000+ ETH, bringing its holdings to more than $12 billion as Fundstrat co-founder Tom Lee talks about how “absurd” AI valuations can still deliver be lucrative long-term bets. Read on for all the details.

Choppy Seas: Norwegian Cruise Line stock just triggered a rare Death Cross, signaling a potential downturn amid leadership changes and market uncertainty. Click to see why traders are on alert, and what everyone is watching next.

Stock Of The Day: Shares of Broadcom have been stuck in a steep downtrend over the past week despite topping analyst estimates on the top and bottom lines. Is a turnaround in sight? With shares near a critical support level, here’s everything you need to know.

SPECIAL OFFER

Get breaking market news before mainstream sources, plus AI-powered analysis and professional tools that quickly turn market noise into actionable opportunities. Try it for free right now.

MARKET HISTORY

On This Day In 1930…

Walt Disney Studios reorganized as a corporation under the name Walt Disney Productions, a pivotal step that laid the foundation for what would become one of the most influential publicly traded companies in U.S. market history. The incorporation allowed Disney to better raise capital, protect intellectual property, and scale its operations during the early growth of animated film and merchandising. This transition ultimately set the stage for Disney’s eventual public listing and its evolution into a global media and entertainment powerhouse. The company’s market cap was less than $5 million at the time of its IPO, and now has a market cap of $200 billion.

QUOTE OF THE DAY

“Figure out what something is worth and pay a lot less“

— Joel Greenblatt

BEFORE YOU GO

Were you forwarded this email? Click here to subscribe.

And be sure to check out our other newsletters:

Future Finance: Where fintech, crypto and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Advisor: Tailor-made for Financial Advisors, this weekly newsletter has industry-specific insights, analysis, and news. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets and mind-blowing tech trends. Subscribe here.