- Ring The Bell

- Posts

- 🕊️Powell's Dovish Tone Shocks Wall Street, And Could Nvidia’s Latest Reveal Fuel Another Tech Rally?

🕊️Powell's Dovish Tone Shocks Wall Street, And Could Nvidia’s Latest Reveal Fuel Another Tech Rally?

Plus, earnings winners and laggards, 5 stocks to watch, and more

Happy Monday! Stocks rallied sharply after Fed Chair Jerome Powell struck a surprisingly dovish tone during his speech in Jackson Hole, sparking fresh questions about the future of interest rates and economic growth. Read on to explore what this means for the market and your investments.

Also, from humanoid robots to delivery drones, Nvidia’s AI tech is behind them all, and it just hit a major milestone. Could this be its next breakout moment? Read more.

Plus, Benzinga is hosting the biggest Fintech conference of the year. Click here for more details, and come join the biggest names in Fintech.

In Today's Edition

TOP STORY

With the whole world watching, Federal Reserve Chair Jerome Powell struck a surprisingly dovish tone during his speech in Jackson Hole, warning that downside risks to the U.S. labor market are rising and that monetary policy "may warrant adjusting" if the economic slowdown deepens.

This was all Wall Street needed to hear in order to soar to new highs on Friday. Many economists and investors had expected Powell to avoid any hint of a rate cut, instead reiterating the Fed's wait-and-see stance. Instead, Powell's speech delivered a clear signal that has the markets cheering. Read on for all the insights and analysis.

SPECIAL EVENT

The 11th annual Benzinga Fintech Day & Awards is where ideas become deals. Join top-tier VCs, tech founders and decision-makers from leading financial institutions on November 10, 2025, in NYC. Explore key topics like 24/5 trading, bridging digital assets and equities and the future of retail investing. From speed networking to 1:1 investor meetings, this is where fintech conversations drive action — and results. Celebrate innovation, spark partnerships and shape what's next.

MARKET RECAP

| Averages & Assets | ||||

| Asset | Close 08/22/25 | Price Change | ||

| $6,466.91 | +1.52% | ||

| $21,496.54 | +1.88% | ||

| $45,631.74 | +1.89% | ||

| 4.26% | -0.08 bps | ||

| $38.18 | +10.41% | ||

| $662.66 | -5.03% | ||

| $116,834.00 | +3.93% | ||

| $4,829.23 | +14.32% | ||

| $3.07 | +7.72% | ||

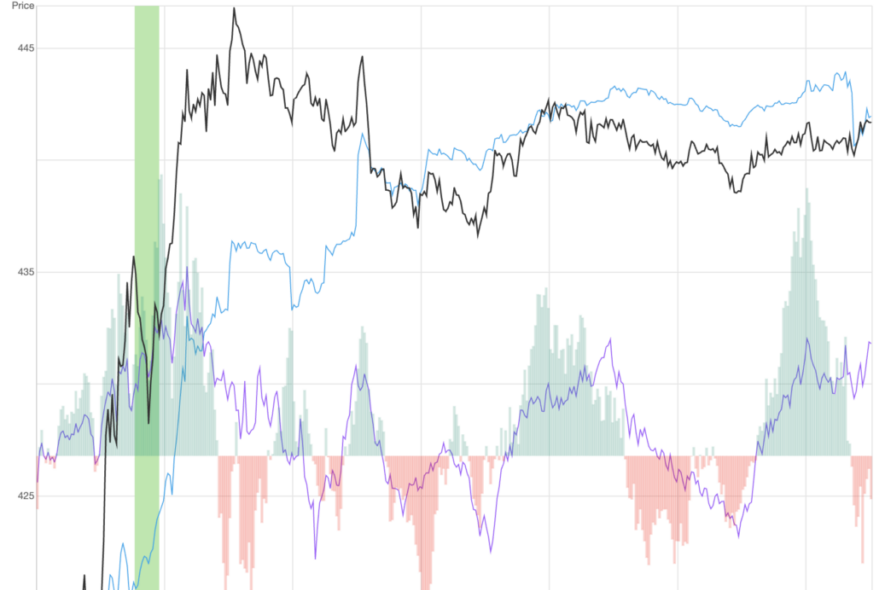

Last Week: After a rough start to the week, U.S. indexes rebounded sharply on Friday as the markets soared after Fed Chair Jerome Powell struck a dovish tone during his speech in Jackson Hole. The Dow surged more than 800 points and finished up nearly 2% on the day, helping it to move into positive territory (1.5%) on the week. The index also hit a new record high (45,757.84) in the process. The indexes were headed for one of their worst weeks since April, until Powell’s speech powered the indexes to new highs. The Fed Chair acknowledged softer labor-market data and noted that “the shifting balance of risks may warrant adjusting our policy stance,” boosting expectations that a rate cut will happen next month.

On Our Radar: Analysts will be watching new home sales data as well as speeches from Fed Presidents Lorie Logan and John Williams later in the day. On the earnings front, all eyes will be on Heico (HEI) and Semtech (SMTC) which will report earnings after the market close today.

MARKET HEATMAP

Jerome Powell’s dovish tone was all the market needed to blast off, with the Dow hitting record highs. From Enphase (ENPH) and Delta (DAL) to Coinbase (COIN) and On Semiconductor (ON), everything was soaring on Friday. Here’s a look at some of the biggest movers.

Discover how the market is moving with our interactive heatmap. Filter by market cap, or click on any box to explore specific sectors in more detail.

FIVE ZINGERS

SPECIAL OFFER

The earnings season continues with Nvidia taking the center stage this week in a move that could shake the entire market. Our Earnings Command Center gives you real-time alerts, key data and actionable insights so you can position before Wall Street reacts.

MARKET HISTORY

On This Day In 1995…

Berkshire Hathaway announced it would acquire the remaining shares of GEICO, the auto insurance company. Warren Buffett, who had first invested in GEICO in 1951, called it one of the best investment decisions of his life. The acquisition, completed in early 1996, gave Berkshire full ownership of the insurer and marked a major expansion of its insurance operations — an area that would become a cornerstone of Buffett’s long-term investment strategy.

QUOTE OF THE DAY

“Amateurs think about how much money they can make. Professionals think about how much money they could lose.“

— Jack Schwager

ONE FOR THE ROAD

Nvidia isn’t just fueling the AI software boom; it’s building the muscle behind the machines of tomorrow. The company is making bold moves beyond data centers, as it has been quietly powering a new class of AI-driven robots across healthcare, manufacturing, agriculture and food delivery.

As the company celebrates a major developer milestone, it’s also lifting the curtain on a growing ecosystem of startups building the next generation of autonomous machines — with Nvidia’s tech at their core. With Nvidia’s next earnings release on Wednesday, analysts are watching closely to see if this robotics wave could trigger yet another trillion-dollar valuation rally.

BEFORE YOU GO

Were you forwarded this email? Click here to subscribe.

And be sure to check out our other newsletters:

Future Finance: Where fintech, crypto and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Advisor: Tailor-made for Financial Advisors, this weekly newsletter has industry-specific insights, analysis and news. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets and mind-blowing tech trends. Subscribe here.