- Ring The Bell

- Posts

- 🐶 Two-Dog Race

🐶 Two-Dog Race

Which dog-themed crypto will win the crypto rally, Snowflake's stock melts and more

Happy Thursday Zingernation! Bad news first: inflation is back. At least according to hedge funder Kyle Bass who tweeted his receipt from breakfast at an NYC hotel. It added up to more than $100 for just one meal. The OJ itself was $14.

The good news? This was at the Carlyle Hotel, a 5-star hotel with rooms starting at about $1,000 a night. I’ll just stick to the continental breakfast with the DIY waffle maker at my local Mariott.

Also, looking to earn some extra money on the side without getting a new job? Check out today’s partner.

And, did someone forward you this email? Click here to subscribe to this Benzinga newsletter and more.

MARKET SNAPSHOT

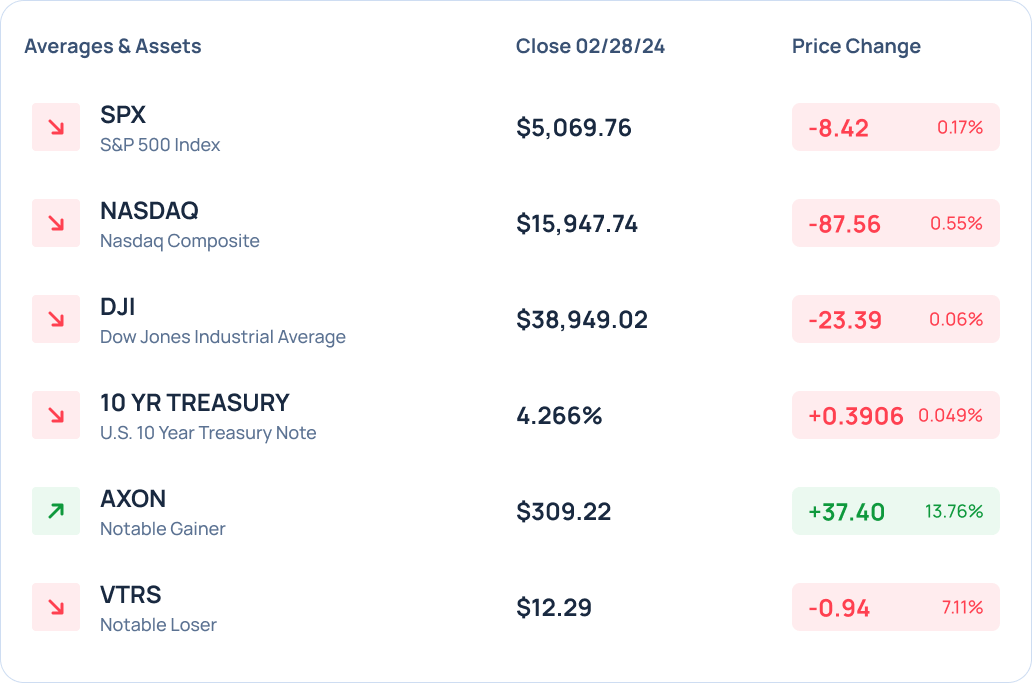

Yesterday: Yuck. Red across the board with tech lagging. Bitcoin was a bright spot and reached $64,000 before dropping back to around $60,000.

On Our Radar: PCE day! PCE data and initial jobless claims came out at 8:30 am ET. We’ll also hear from a slew of Federal Reserve officials throughout the day.

TOP STORY

Briefly: If I owned nearly 200,000 Bitcoin, I’d be anything but humble. Michael Saylor, CEO of MicroStrategy does (counting MicroStrategy’s holdings). But Saylor encouraged his X followers to “Stack Sats” and stay humble.

Whale Watch: Saylor’s MicroStrategy is the largest corporate Bitcoin holder. It has 174,530 BTC in its pile, valued at $10.71 billion at current prices, according to CoinGecko data.

Why It Matters: Benchmark’s recent $990 price target for MicroStrategy factored in the anticipation of Bitcoin surging to $125,000 by the end of 2025.

Double Down: MicroStrategy amassed around 3,000 Bitcoin tokens for $155.4 million in February. This was part of their ongoing purchases since 2020 to hedge against inflation and as an alternative to holding cash.

Learn More: Check out the full story here.

PRESENTED BY FINANCE BUZZ

There’s nothing to be ashamed of if you're living paycheck to paycheck or struggling to make ends meet.

But not all of us have the time or luxury of picking up another job to make extra cash. It's tiring to work so many hours for very little take-home pay.

Thankfully, there are a few ways that you can make some money (and save some too) by not getting a job. If you're struggling financially, here are 6 insanely easy things you can do right now that could help.

FIVE ZINGERS

Dog Fight: During the last big crypto rally, Dogecoin stole the spotlight. But now there’s a different dog coin coming for its bone.

Whoa, We’re Half Way There: And the bears could be living on a prayer. At least according to one analyst, who expects this rally to continue till 2027.

Missed It By That Much: The U.S. government got its act together in the nick of time and avoided a government shutdown… for now.

Snowfall: $SNOW’s stock was falling after the close yesterday following the cloud data company’s report of worse-than-expected earnings.

Early Bird Gets The Gains: If Bitcoin were a person, it’d be old enough to drive. Here’s how much you’d have if you put in just $1 when it came out.

ONE FOR THE ROAD

In Short: One analyst is betting on $DKNG by raising his price target for the gambling company. This happened after DraftKings reported fourth-quarter financial results and raised 2024 guidance.

The Takeaways: Morgan Stanley analyst Stephen Grambling had an Overweight rating and raised the price target from $40 to $49. Capital allocation and strong EBITDA from DraftKings lead to the increased price target.

Quoted: "We are raising estimates to reflect DKNG's 4Q results, updating our 2024-2026 industry estimates for better market trends along with DKNG's acquisition of Jackpocket," Grambling said.

The Balance Sheet: Grambling estimated that DraftKings would have $1.2 billion in cash on its balance sheet at the end of fiscal 2024. The Jackpocket deal is expected to close during the second half of 2024.

What Next: Read the full breakdown here.

PRESENTED BY FINANCE BUZZ

You’ve got just enough money in your bank account to last until Friday … but then Monday rolls around, and you’re in the same situation. Again. Food. Bills. Rent. Gas. They dry up every bit of your take-home pay.

But it doesn’t have to be this hard. With a few smart moves, you could supplement your income and afford that next vacation — without doing much extra “work,” or even getting a side job. Check out this FinanceBuzz article to find a solution and take control of your finances today.