- Ring The Bell

- Posts

- Warren Buffett On Verge Of Biggest Buyout Since 2022 + Pfizer Slashes Drug Prices In Historic Trump Deal

Warren Buffett On Verge Of Biggest Buyout Since 2022 + Pfizer Slashes Drug Prices In Historic Trump Deal

Plus, Cathie Wood's latest picks, Nike earnings, and more

Happy Wednesday! Pfizer and the White House announced steep drug price cuts, which have sparked a wave of questions across the pharmaceutical landscape. What’s really driving this move, and how might it reshape the industry — and your wallet? Read on for all the details.

Also, Warren Buffett is reportedly preparing his biggest buy since 2022, a move that could be his final act in dealmaking and reshape Berkshire Hathaway’s future. Read on to see what’s behind this $10 billion move and why it matters.

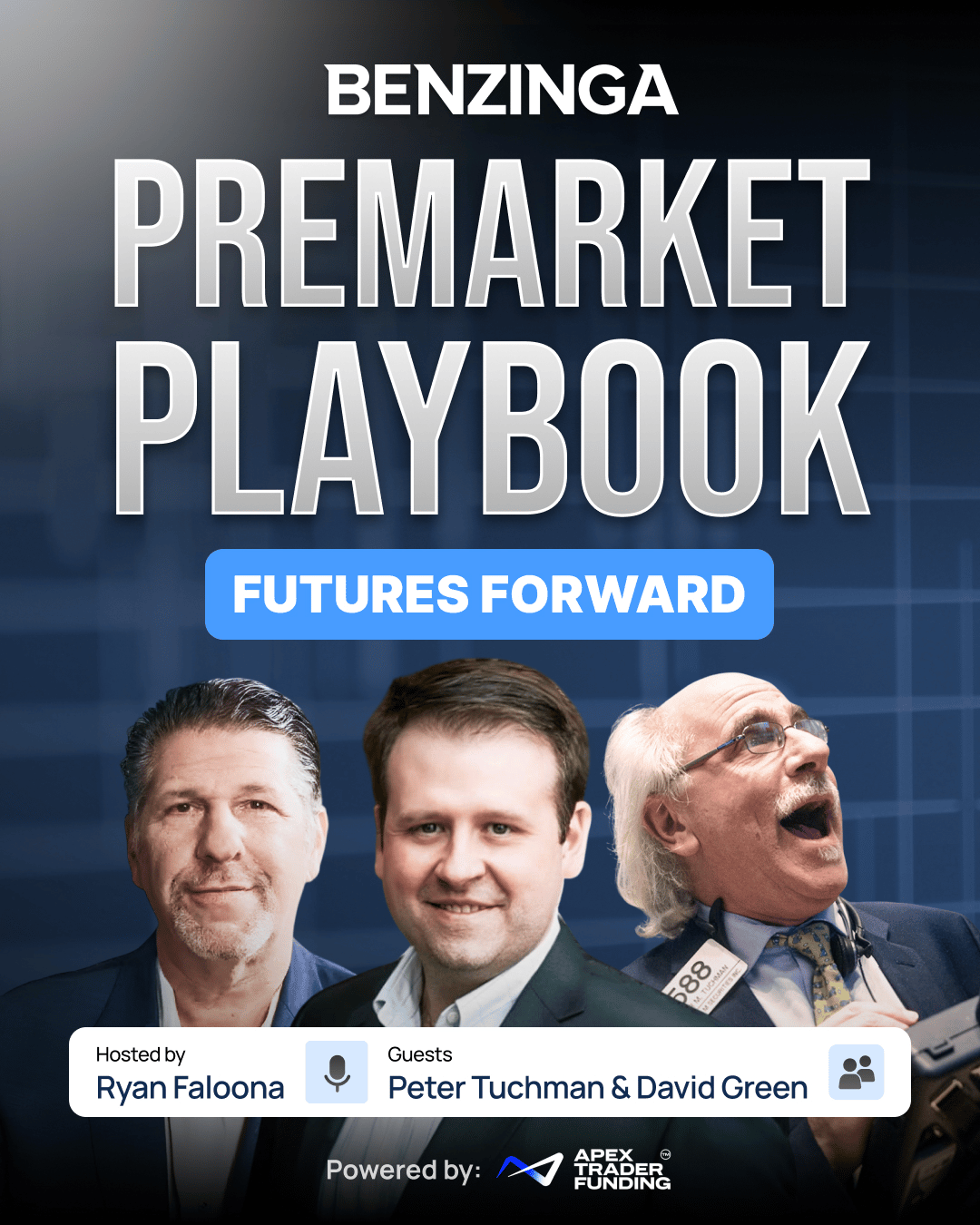

Plus, if you’re looking to stay ahead in the fast-moving world of futures trading, check out Benzinga’s newest segment on PreMarket Playbook, sponsored by Apex Trader Funding.

In Today's Edition

TOP STORY

Pfizer and the White House have shaken up the pharmaceutical world by pledging steep price cuts — up to 85% — on some of its most widely used drugs.

Is this a victory for American patients, or is there something more going on behind the scenes that isn’t being discussed? After all, companies aren’t in business to lose money.

Read on for the full breakdown to see what Pfizer is giving up and what it’s getting in return, and what it means for the industry and the future of American drug pricing.

SPONSORED CONTENT

Whether you're banking on the direction of oil or gold or shorting the S&P 500, the futures market moves fast. What was up one minute could be down the next. Keeping up with it all can be dizzying.

It just got a lot easier to navigate, thanks to Futures Forward, presented with Apex Trader Funding, a new segment on Benzinga’s PreMarket Playbook with Peter Tuchman & David Green.

Bringing the futures market to viewers in the mornings, the new segment provides traders with fresh and actionable insights about the futures markets, all before the opening bell.

The futures market moves fast — are you ready to keep up? Catch Futures Forward to be primed and ready to get your futures trading on when the markets open.

MARKET RECAP

| Averages & Assets | ||||

| Asset | Close 09/30/25 | Price Change | ||

| $6,688.46 | +0.41% | ||

| $22,660.01 | +0.31% | ||

| $46,397.89 | +0.18% | ||

| 4.15% | +0.01 bps | ||

| $198.26 | +6.56% | ||

| $81.08 | -6.68% | ||

| $114,024.00 | -0.25% | ||

| $4,144.23 | -1.69% | ||

| $2.84 | -1.39% | ||

Yesterday: U.S. indexes finished higher Tuesday — reversing early losses — to round out a strong September as major indexes posted solid monthly gains. The Nasdaq led the way, up 5.6%, the S&P 500 rose more than 3% — a sharp contrast to its five-year average (-4.2%) — while the Dow added nearly 2%. Wall Street continues to look past concerns of the start of a government shutdown, and instead, is focusing on the projected length of the closure, which could delay key economic data ahead of the Federal Reserve’s meeting later this month. Treasury yields edged higher, with the 10-year yield reaching 4.16%. The U.S. dollar weakened, and oil prices continue to fall on expectations of increased OPEC+ production.

On Our Radar: Analysts will be watching several reports, including ADP employment, manufacturing PMI, construction spending and auto sales. On the earnings front, all eyes will be on AngioDynamics (ANGO), which will report before the market opens tomorrow.

MARKET HEATMAP

Shares of Danaher (DHR) were soaring while Albemarle (ALB) was plummeting… But those weren’t the only companies making big moves. Here’s a look at some of the biggest winners and losers on Tuesday.

Discover how the market is moving with our interactive heatmap. Filter by market cap, or click on any box to explore specific sectors or assets in more detail.

FIVE ZINGERS

SPECIAL OFFER

Markets are bracing for the impact of the government shutdown, and that means volatility is about to surge. Matt Maley’s strategy is built to trade those swings, already turning fast-moving moves into triple-digit gains. Now you can see his next trades free for 7 days, just as Washington gridlock shakes the market.

MARKET HISTORY

On This Day In 1928…

The Dow Jones Industrial Average (DJIA) was expanded from 20 to 30 stocks, marking a pivotal moment in the evolution of U.S. market indices. This expansion not only made the index more representative of the broader American industrial economy but also introduced the use of a "divisor" to calculate the average, allowing for smoother adjustments when components changed due to stock splits or substitutions. New additions to the index included major players like Chrysler, Goodrich and ExxonMobil.

QUOTE OF THE DAY

“People calculate too much and think too little.“

— Charlie Munger

ONE FOR THE ROAD

Warren Buffett may be preparing to make his boldest move in years — and it's not in oil, railroads or insurance. Berkshire Hathaway is reportedly in advanced talks to acquire OxyChem, the chemical arm of Occidental Petroleum, in a potential $10 billion deal — making it Buffett’s biggest buy since 2022.

With Occidental ties already deep, this move hints at a broader game plan involving legacy investments, industrial infrastructure and possibly, the future of clean technology.

Read on for the full breakdown and why it could be Buffett’s final act in dealmaking.

BEFORE YOU GO

Were you forwarded this email? Click here to subscribe.

And be sure to check out our other newsletters:

Future Finance: Where fintech, crypto and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Advisor: Tailor-made for Financial Advisors, this weekly newsletter has industry-specific insights, analysis and news. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets and mind-blowing tech trends. Subscribe here.